First-time buyers must understand flood zone maps, crucial for assessing property safety, financing, and insurance requirements. These maps, created by agencies like FEMA, categorize areas based on flooding risk, influencing borrowing power and long-term investment. By reviewing maps, consulting lenders, and considering local regulations, buyers can avoid financial surprises, ensure smoother transactions, and protect their investments.

In the real estate market, understanding one’s surroundings is paramount, especially when it comes to potential risks like flooding. For first-time homebuyers, navigating the complexities of flood zones can seem daunting. This comprehensive report aims to demystify the process by providing an in-depth guide to flood zone maps—essential tools for assessing property risks. We’ll break down the significance of these maps, highlight common challenges buyers face, and offer practical insights to ensure informed decisions. By the end, readers will possess the knowledge to confidently wade through this crucial aspect of homeownership.

Understanding Flood Zones: A Primer for Buyers

Understanding Flood Zones: A Primer for Buyers

When considering a purchase in a new community, one often overlooked yet critical aspect is the flood zone map. This comprehensive guide aims to demystify these maps and equip first-time buyers with the knowledge to make informed decisions. A flood zone map visually represents areas prone to flooding based on historical data and regulatory standards. It’s more than just a graphic; it’s a tool that can significantly impact your borrowing power, insurance requirements, and long-term financial health.

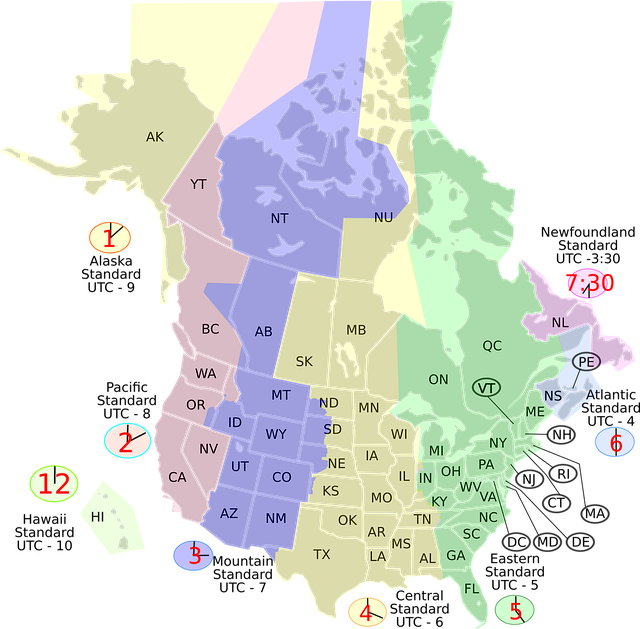

These maps are developed by local and national agencies like the Federal Emergency Management Agency (FEMA) in the U.S., which uses sophisticated modeling to identify areas at risk of flooding from various sources, including rivers, oceans, and heavy rainfall. The resulting zones are categorized based on their likelihood of inundation, ranging from low to high risk. Understanding these classifications is paramount for borrowers as lenders often have specific requirements when financing a property in flood-prone areas. For instance, loans secured in high-risk zones may carry higher interest rates or require private flood insurance in addition to the standard home owner’s policy.

For first-time buyers, navigating these complexities can seem daunting, but it doesn’t have to be. Start by reviewing your local community’s flood zone map and understanding its implications for property ownership. Check if your desired property falls within any designated zones and consult with a lender who specializes in dealing with such areas. They can provide insights into potential loan restrictions and guide you on necessary precautions. Remember, being proactive about these factors not only ensures a smoother buying process but also helps protect your investment over the long term, as properties in high-risk flood zones may face stringent resale considerations.

Accessing Your Area's Flood Zone Map Online

Accessing Your Area’s Flood Zone Map Online is a critical step for first-time homebuyers, offering invaluable insights into property safety and potential risks. Many lenders now require borrowers to review these maps as part of their loan application process, ensuring informed decisions are made regarding real estate investments. The flood zone map serves as a comprehensive visual guide, categorizing areas based on their susceptibility to flooding events, ranging from low-risk to high-risk zones.

Online platforms provide easy access to these essential tools, allowing prospective buyers to explore their desired neighborhoods in detail. Most local governments and national mapping agencies offer dedicated websites where users can input addresses or search for specific locations. These interactive maps often include color-coded representations of floodplains, river flood hazards, and coastal flooding zones, making it simple to identify areas prone to water intrusion. For instance, the Federal Emergency Management Agency (FEMA) in the United States offers a National Flood Map service, providing detailed data on flood risks across the country. Borrowers can utilize this resource to assess their potential exposure to floods, which is a significant factor influencing home insurance premiums and loan eligibility.

When utilizing online flood zone maps, borrowers should pay close attention to the map’s legend and scale for accurate interpretation. Additionally, comparing multiple maps for consistency across different sources can enhance understanding. By familiarizing themselves with these tools early in their search, buyers can make more informed choices, avoiding potentially costly surprises post-purchase. This proactive approach aligns with borrower requirements set by lenders, who prioritize mitigating risks associated with flood-prone properties.

Interpreting the Data: What Does the Map Show?

When reviewing a property for purchase, understanding the flood zone map is an indispensable step, especially for first-time buyers. This map offers critical insights into areas prone to flooding, indicating zones that have experienced inundation in the past or are at high risk based on geographical and environmental factors. By deciphering this data, borrowers can make informed decisions about their real estate investments.

The flood zone map borrower requirements vary depending on the region and local regulations. In many cases, lenders mandate a thorough inspection to verify the property’s location relative to these maps. This process ensures that potential buyers are fully aware of any associated risks before proceeding with the purchase. For instance, properties in areas designated as Special Flood Hazard Zones (SFHZ) often require flood insurance, which can impact financing options and overall costs. Understanding these requirements upfront is crucial for borrowers navigating the mortgage process.

Beyond risk assessment, these maps provide valuable context for property values. Historically flooded areas may have experienced significant drops in value, while properties outside of flood zones tend to hold or appreciate more steadily. This knowledge empowers buyers to negotiate prices and manage expectations. For instance, a comparison of sales data within and outside a designated flood zone can offer stark contrasts, highlighting the financial implications of the area’s historical flooding. By interpreting this data, first-time borrowers can make well-informed choices that align with their financial goals and risk tolerances.

Assessing Risk: How to Use the Flood Zone Map

When navigating the real estate market as a first-time buyer, understanding your potential property’s relationship with the flood zone map is paramount. This isn’t merely about aesthetic considerations; it’s a critical factor in assessing risk and making informed decisions. The flood zone map serves as a comprehensive guide, delineating areas prone to flooding based on historical and scientific data.

By consulting this resource, borrowers can gain insights into the likelihood of their future home experiencing water intrusion during severe weather events. For instance, regions categorized as Special Flood Hazard Areas (SFHA) on the map indicate high flood risks, necessitating more stringent insurance requirements for any construction or renovation projects. These zones are further subdivided based on the level of risk—from low to moderate to high—allowing prospective buyers to weigh these factors alongside other property attributes.

Integrating the flood zone map into your search and evaluation process is a proactive step toward mitigating potential financial exposure. Lenders, too, require this information as part of their borrower requirements when processing mortgage applications. They assess the risk associated with the property’s location to determine appropriate loan terms, including interest rates and insurance policies. For instance, properties in high-risk zones may be subject to higher interest rates or require specific flood insurance coverage, impacting the overall borrowing cost.

Therefore, first-time buyers are advised to thoroughly study the flood zone map data, seeking professional guidance when needed. This ensures they’re fully apprised of potential risks and can make confident decisions about their future home’s purchase while adhering to lender guidelines for borrower requirements pertaining to flood zones.

Mitigating Risks: Options for First-Time Homeowners

For first-time homebuyers, navigating the complexities of purchasing a property within a flood zone can be a daunting task. Understanding and mitigating risks associated with these areas is paramount to ensure financial security and make informed decisions. A flood zone map serves as a crucial tool, providing detailed information on zones prone to flooding, helping borrowers assess potential hazards. These maps, developed by federal agencies like the Federal Emergency Management Agency (FEMA), are essential resources for both buyers and lenders when evaluating real estate transactions.

One of the primary considerations for first-time homeowners is recognizing that properties in flood zones often carry unique borrower requirements. Lenders typically mandate specific measures to protect investments and ensure compliance with regulatory frameworks. These requirements may include mandatory purchase of flood insurance, implementation of protective structures, or meeting enhanced structural standards. For instance, according to FEMA data, over 9 million homes are located in high-risk flood zones across the United States, highlighting the significant impact these maps have on mortgage lending practices. Lenders use these maps to assess risk and underwrite loans, ensuring borrowers understand and accept the associated responsibilities.

Mitigating risks effectively involves a multi-step approach. First, homebuyers should conduct thorough research using the latest flood zone maps to identify potential areas. Engaging with local authorities and emergency management agencies can provide valuable insights into historical flooding events and future predictions. Additionally, consulting with professionals like surveyors or engineers who specialize in flood risk assessment can offer detailed analyses. These steps empower borrowers to make informed choices, either by exploring properties outside at-risk zones or taking necessary precautions to elevate and protect structures.

Understanding the intricacies of a flood zone map borrower requirements process is essential for successful homeownership. By proactively addressing these considerations, first-time buyers can avoid potential pitfalls and secure funding while minimizing future financial exposure related to flooding. This proactive approach not only protects lenders but also ensures homebuyers have a clear understanding of their responsibilities, fostering a more robust and resilient real estate market.