First-time homebuyers in areas prone to flooding must understand flood zone maps, which visualize high-risk zones based on topography, water bodies, historical events, and other factors. These maps influence loan eligibility, insurance requirements, and property costs. Key indicators include the 100-year flood plain and Special Flood Hazard Areas (SFHAs). Lenders may mandate higher down payments or safety measures in these zones. Beyond maps, buyers should consider local building codes, topography, water flow patterns, historical events, community preparedness, and proximity to infrastructure. Engagement with local officials and experts ensures compliance, mitigates risks, and facilitates informed purchasing decisions.

In the real estate market, understanding your property’s location is paramount, especially when it comes to potential risks like flooding. For first-time buyers, navigating the complexities of flood zone maps can be daunting. This comprehensive report aims to demystify these maps, providing an authoritative guide for buyers seeking to avoid or prepare for such scenarios. Flood zone maps, critical tools for assessing risk, indicate areas prone to flooding, enabling informed decisions. By delving into their intricacies, this article promises to equip readers with the knowledge needed to make secure investments while mitigating potential losses.

Understanding Flood Zone Maps: A Primer for Buyers

Understanding Flood Zone Maps is a critical step for any first-time buyer navigating the real estate market, especially in areas prone to flooding. These maps, provided by government agencies, offer detailed visualizations of regions at risk of flooding, enabling prospective buyers to make informed decisions about their future home’s safety and potential financial implications. A flood zone map serves as a crucial tool for borrowers as it directly impacts loan eligibility, insurance requirements, and the overall cost of purchasing a property.

When assessing a property, lenders will refer to these maps to determine if a particular area falls within a special flood hazard zone. Properties located in these zones are considered high-risk, which can lead to stricter loan criteria for borrowers. For instance, lenders may require additional safety measures or higher down payments from borrowers purchasing homes in 100-year flood zones, as per Federal Emergency Management Agency (FEMA) standards. This is because such areas have a one percent chance of experiencing flooding in any given year, making them more susceptible to severe weather events. By understanding the flood zone map, buyers can anticipate these requirements and plan accordingly.

Moreover, knowledge of local flood zones empowers borrowers to explore insurance options tailored to high-risk properties. Flood insurance is mandatory for homeowners in many flood-prone areas, and understanding the extent of the risk allows buyers to budget effectively and choose the right coverage. Recent data from FEMA indicates that nearly 14 million people live in high-risk flood zones across the United States, underscoring the significance of these maps for responsible borrowing and risk management. In light of this, first-time buyers should prioritize researching and interpreting flood zone maps as part of their home-buying journey to ensure a smooth transition into homeownership.

Identifying High-Risk Areas Using Geographic Data

Identifying high-risk areas is a critical step for any first-time buyer navigating the complexities of property acquisition, especially when it comes to understanding flood zone maps. These detailed maps, integral to borrower requirements, offer invaluable insights into potential hazards and are crucial tools in mitigating financial risks associated with purchasing real estate. By scrutinizing geographic data, buyers can gain a clearer picture of areas prone to flooding, enabling informed decisions that protect both their investments and safety.

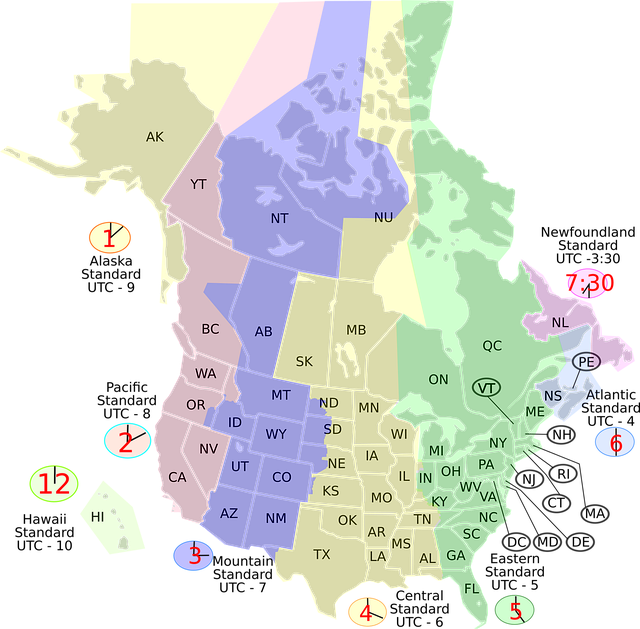

Geographic data plays a pivotal role in mapping out flood-prone zones. It involves a comprehensive analysis of various factors such as topography, water bodies, drainage patterns, and historical flood events. Advanced technologies like remote sensing and GIS (Geographic Information Systems) are employed to collect and interpret these data points, creating precise representations of areas likely to experience flooding during heavy rainfall or storm surges. For instance, regions with low-lying elevations, poor drainage systems, or proximity to rivers and coastal areas often fall within high-risk categories on the flood zone map.

Understanding the nuances of a flood zone map is essential for borrowers as it directly impacts loan eligibility and insurance requirements. Lenders typically conduct thorough assessments using these maps to evaluate the risk associated with lending in specific locations. Properties situated in 100-year flood zones, as identified by the Federal Emergency Management Agency (FEMA), often face stricter borrowing guidelines and may require private mortgage insurance (PMI). Borrowers should be aware of these potential hurdles and plan accordingly to ensure a smooth purchasing process. For example, buyers considering real estate in coastal regions, such as areas prone to hurricanes, must anticipate more stringent lending criteria due to the heightened flood risks.

By thoroughly researching and interpreting flood zone maps, first-time buyers can make more informed decisions when selecting a property. This proactive approach allows them to weigh the potential risks against the benefits, ensuring they obtain financing that aligns with their unique circumstances. Engaging with professionals who specialize in geographic data analysis or consulting with mortgage lenders familiar with borrower requirements can further facilitate this process. Ultimately, embracing a comprehensive understanding of flood zone maps empowers buyers to navigate the real estate market with confidence and make sound investments.

Interpreting Map Layers: What to Look For

When examining a flood zone map for the first time, borrowers must develop a keen eye for interpreting its various layers. Each layer represents critical data that can significantly impact their purchasing decisions. Understanding these elements is crucial, especially in regions prone to flooding, where a comprehensive flood zone map serves as a vital tool for assessing risk and making informed choices.

Focus on identifying key indicators such as the 100-year flood plain, which denotes areas with a 1% chance of experiencing flooding in any given year. This is often color-coded on the map, typically in shades of blue or purple. Additionally, look for zones classified as Special Flood Hazard Areas (SFHAs), indicating areas historically prone to flooding from various sources, including rivers, streams, and coastal regions. These areas are usually highlighted with specific symbols or patterns. Borrowers should also pay attention to elevation data, as properties in lower-lying areas within a flood zone are generally at higher risk.

The flood zone map borrower requirements extend beyond identifying high-risk zones. It’s essential to consult local building codes and regulations, as they dictate the level of protection required for new constructions or renovations in these areas. Understanding these guidelines ensures that any development aligns with safety standards, minimizing potential future damage. For instance, in some regions, buildings in flood-prone areas must be elevated above a certain height or equipped with robust floodproofing measures to comply with regulations and reduce borrower exposure.

Assessing Personal Risk: Factors Beyond the Map

When assessing a property for purchase, especially for first-time buyers, understanding one’s risk factors within a flood zone map is paramount. While the flood zone map provides critical data on areas prone to flooding, it’s just the beginning of the evaluation process. Beyond what the map depicts, several crucial elements must be considered to fully grasp an individual’s vulnerability to flood risks. These include local topography, water flow patterns, and historical flood events. For instance, a property situated near a river might appear within a low-risk zone on the map, but rapid water accumulation upstream or changes in the riverbed could still pose a threat during heavy rainfall.

Additionally, borrower requirements play a significant role. Lenders often mandate specific measures to mitigate risks for properties in flood zones. These may include installing elevation certificates, ensuring proper drainage systems, or even requiring insurance policies tailored to flood coverage. Borrowers should be prepared for potential costs associated with these precautions, as they can vary widely depending on the property’s unique vulnerabilities. Data from recent studies shows that homes built closer to rivers face higher replacement costs post-flooding due to their proximity to essential infrastructure and increased likelihood of damage.

Another critical aspect is awareness of community preparedness measures. Some neighborhoods in flood zones have implemented collective strategies like community flooding response plans, early warning systems, or even specialized local insurance pools. Understanding these initiatives can offer valuable insights into the neighborhood’s resilience and potential savings on insurance premiums for borrowers. First-time buyers should actively engage with local officials and community groups to gain a comprehensive view of their future flood zone environment.

Local Regulations and Insurance Considerations

When purchasing a property for the first time, understanding local regulations and insurance considerations related to flood zones is paramount. The flood zone map serves as a crucial tool, indicating areas prone to flooding based on historical data and predictive models. Borrowers often require this map during their mortgage application process, as lenders assess risk and determine appropriate coverage requirements. According to recent data from the Federal Emergency Management Agency (FEMA), over 13 million properties are located in flood zones across the United States, emphasizing the significance of this information for prospective buyers.

Navigating these regulations involves a multi-step approach. First, obtain a detailed flood zone map from your local government or FEMA, ensuring it aligns with the most current data. Compare this map with the property’s location to assess any potential risks. Local building codes and zoning ordinances often dictate specific construction requirements within flood-prone areas, such as elevated foundations or floodproofed structures. These measures aim to mitigate damage and reduce insurance premiums for borrowers. For instance, in coastal regions, regulations may mandate storm shutters or raised electrical systems to protect against frequent storm surges.

Insurance considerations are an integral part of this process. Flood insurance is mandatory for properties located in high-risk areas, as standard home insurance policies typically exclude coverage for flooding. The National Flood Insurance Program (NFIP) offers flood insurance through approved providers, with rates varying based on location and building characteristics. Borrowers should carefully review the flood zone map borrower requirements to understand the level of coverage needed and ensure they meet these standards. An expert in mortgage lending advises, “Understanding your local regulations and insurance obligations early in the buying process can save borrowers time and money in the long run.”

Mitigating Risks: Steps for First-Time Homebuyers

For first-time homebuyers, navigating the complexities of purchasing a home within a flood zone can seem daunting. Understanding and mitigating risks associated with these areas is paramount to making an informed decision. A crucial tool in this process is the flood zone map, which provides detailed information about areas prone to flooding based on historical data and environmental factors. By familiarizing themselves with this map, borrowers can better assess potential hazards and take proactive steps to safeguard their investment.

One of the primary considerations for first-time buyers is recognizing that certain loan programs have specific requirements regarding flood zone maps. Lenders often use these maps to determine if a property is located in a high-risk area, which can impact mortgage eligibility and terms. For instance, borrowers in or near designated Special Flood Hazard Areas (SFHAs) may be required to purchase private flood insurance, in addition to their standard home owner’s policy, as mandated by federal law. This additional coverage protects both the borrower and the lender against potential financial losses due to flooding events.

To mitigate risks effectively, homebuyers should engage in a thorough evaluation process. This includes consulting with local authorities and real estate professionals who can provide insights into historical flood patterns and ongoing efforts to manage water flow. Additionally, utilizing online resources and mapping tools offered by government agencies allows borrowers to cross-reference potential neighborhoods against current flood zone maps. For example, the Federal Emergency Management Agency (FEMA) offers detailed digital maps that are regularly updated, providing a reliable source for assessing flood risks.

By taking these proactive measures, first-time homebuyers can make more confident decisions when considering properties in areas subject to flooding. Engaging with knowledgeable professionals and utilizing available resources ensures borrowers understand the requirements associated with flood zone map borrower needs and can secure appropriate coverage, thereby minimizing potential financial vulnerabilities down the line.