Flood zone maps are essential tools for first-time homebuyers, providing visual risk assessments based on historical data, hydrological studies, and geospatial analysis. These maps categorize zones as low, moderate, or high risk, with specific borrower requirements often mandating flood insurance for high-risk areas. Key insights include proximity to water bodies, historical flood events, elevation data, and protective infrastructure. Lenders disclose a property's flood zone status, enabling buyers to evaluate risks and consider mitigation strategies. Understanding these maps is crucial for informed investment decisions and risk management in flood-prone areas.

In the realm of real estate, purchasing a property is a significant endeavor, particularly for first-time buyers. One crucial aspect often overlooked is understanding the local flood zone map, especially in areas prone to flooding. Navigating this can be a complex task, as it significantly impacts insurance rates and resale value. This comprehensive report aims to demystify the process, providing an in-depth guide for buyers to decipher flood zone maps effectively. By the end, readers will gain valuable insights, ensuring they make informed decisions while navigating the intricate details of these maps.

Understanding Flood Zone Maps: A Primer for Buyers

Flood zone maps are an indispensable tool for first-time homebuyers, offering critical insights into potential risks and providing essential guidance during the purchase process. These detailed maps visually represent areas prone to flooding, helping borrowers make informed decisions about their future homes’ locations. Understanding flood zone map borrower requirements is pivotal in this process as it ensures buyers are aware of the associated risks and take necessary precautions.

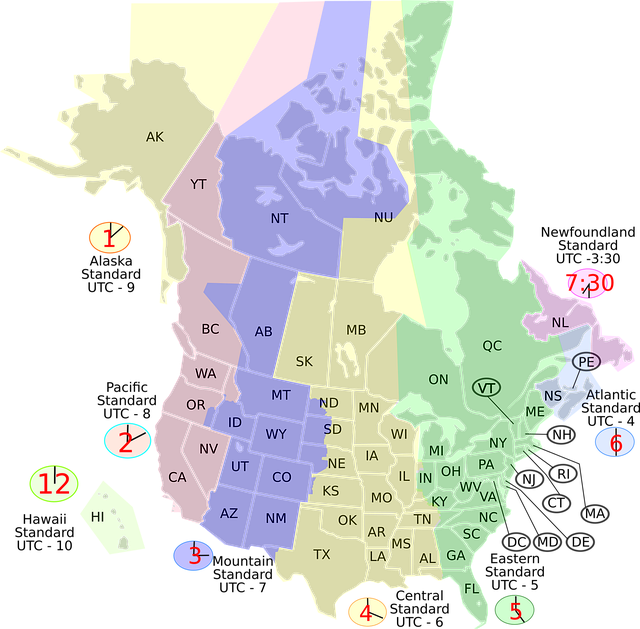

The primary function of a flood zone map is to classify areas based on their susceptibility to flooding events. These maps are developed using historical data, hydrological studies, and geospatial analysis. They typically employ color-coding or zoning designations to indicate different levels of flood risk. For instance, in the United States, the Federal Emergency Management Agency (FEMA) publishes Flood Insurance Rate Maps (FIRMs), which categorize areas as low, moderate, or high flood risk zones. By consulting these maps, borrowers can identify properties within floodplains, coastal zones, or other vulnerable regions.

When a buyer considers a property in a designated flood zone, several key steps should be taken. First, they must assess the specific flood zone map borrower requirements relevant to their location and loan type. Lenders typically mandate flood insurance for properties located in high-risk areas. This insurance protects both the lender and the borrower against potential losses caused by flooding. Additionally, buyers should investigate historical flood data and consult with local experts or real estate agents who can provide insights into past events and their impact on the neighborhood. For example, understanding the frequency and severity of riverine or coastal flooding in a region is crucial for evaluating long-term risks.

While flood zone maps offer valuable risk assessments, they should be viewed as a starting point rather than the sole determinant of a property’s safety. Other factors, such as local building codes, drainage systems, and landscape changes, can influence a property’s resilience to flooding. Thus, borrowers should engage in comprehensive due diligence, incorporating multiple data sources and expert opinions to make well-informed decisions. By combining knowledge from flood zone maps with other relevant information, first-time homebuyers can navigate the market with confidence, ensuring they secure a safe and sustainable investment.

Identifying High-Risk Areas: Tools and Techniques

Identifying high-risk areas is a critical step for first-time homebuyers, especially when navigating the complexities of flood zone maps. These maps, created by regulatory bodies using advanced tools and data analysis, provide invaluable insights into potential flood hazards. Understanding how these maps are developed and what they signify is essential for borrowers to make informed decisions about their future homes.

One of the primary tools employed in creating flood zone maps is geographic information systems (GIS). GIS technology allows experts to layer various datasets—such as topography, rainfall patterns, and historical flood data—to generate precise risk assessments. For instance, a study by the National Oceanic and Atmospheric Administration (NOAA) utilized advanced GIS models to predict flood zones with remarkable accuracy. Additionally, remote sensing techniques, including satellite imagery analysis, play a significant role in mapping out low-lying areas prone to flooding.

Furthermore, borrowers should familiarize themselves with specific regulatory frameworks governing flood zone maps. In many jurisdictions, lenders are required to assess properties against these maps as part of the borrower requirements process. This ensures that potential buyers understand the associated risks and make informed choices. For example, in regions like the United States, the Federal Emergency Management Agency (FEMA) publishes detailed flood maps, which are regularly updated to reflect changing environmental conditions. By consulting these maps and engaging with lending institutions, first-time homebuyers can gain a comprehensive understanding of their property’s vulnerability to flooding.

Interpreting Map Data: What to Look For

When perusing a flood zone map for the first time, several key elements come into play. These maps, designed to illustrate areas prone to flooding, offer crucial insights for potential homebuyers and investors alike. Understanding this data is paramount as it directly influences borrower requirements, particularly in regions where flooding poses significant risks. Key factors on these maps to look for include water bodies like rivers, lakes, or oceans, historical flood events, elevation data, and the location of levees or other protective infrastructure.

For instance, a close inspection might reveal that a seemingly desirable property sits mere blocks from a large river known for periodic overflows. Such proximity increases the likelihood of damage during heavy rainfall or spring thaw, impacting both property value and borrower requirements. Conversely, elevated terrain typically offers better protection, as demonstrated by areas situated on higher ground avoiding recent flood events despite significant precipitation.

Lenders and borrowers alike must scrutinize these maps, as they play a significant role in risk assessment. According to FEMA data, over 13 million properties are located in high-risk flood zones nationwide. This underlines the importance of comprehensive map analysis before finalizing any real estate transaction. Borrowers should anticipate potential insurance requirements, such as flood insurance policies, which can significantly impact financial outlay, especially for properties in high-risk areas.

In navigating these complexities, borrowers and their advisors are encouraged to consult with local experts, including real estate agents and mortgage specialists, who can offer insights tailored to specific regions and market conditions. This collaborative approach ensures a thorough understanding of flood zone map data, enabling informed decisions that align with borrower requirements and mitigate potential financial burdens.

Evaluating Personal Risk: Considerations for Purchase

When considering a property purchase, especially in an area prone to flooding, understanding your personal risk is paramount. A flood zone map serves as a crucial tool for first-time buyers, providing detailed information about the likelihood and potential impact of flooding in specific locations. This map, often produced by local governments or regulatory bodies, categorizes areas based on their vulnerability to floodwaters, aiding borrowers in making informed decisions.

Evaluating risk is a multifaceted process that requires an in-depth look at both historical data and current conditions. Borrowers should examine past flood events, including depth and velocity, to gauge the severity and frequency. For instance, properties situated within 100 feet of a river or stream are statistically more at risk compared to those farther away. Additionally, local climate patterns and topographical features significantly influence water flow and accumulation. Understanding these factors empowers buyers to identify high-risk zones and consider alternative strategies for mitigation.

The flood zone map borrower requirements often involve specific disclosure protocols. Lenders are mandated to provide potential borrowers with comprehensive information about the property’s flood zone status, enabling them to make informed choices. This process may include site visits, historical data analysis, and consultations with regulatory experts. For instance, in areas prone to seasonal flooding, buyers should inquire about temporary or permanent flood protection measures already in place. Some properties might have elevated foundations or be equipped with advanced drainage systems, significantly reducing the risk for borrowers.

By integrating a thorough evaluation of personal risk into their search, first-time homebuyers can navigate the complexities of property acquisition in flood-prone areas with confidence. This proactive approach ensures that any decisions made are aligned with current data and expert insights, fostering a more secure and sustainable investment strategy.

Mitigating Flood Hazards: Steps for Homebuyers

For first-time homebuyers, navigating the complexities of purchasing a home within a flood zone can seem daunting. Understanding and mitigating flood hazards is an essential step in this process. A flood zone map serves as a critical tool, providing detailed information about areas prone to flooding. These maps, often mandated by local governments, are designed to help borrowers make informed decisions and lenders assess risk. By analyzing the flood zone map borrower requirements, homebuyers can take proactive measures to safeguard their investment.

One of the primary steps is to obtain an up-to-date flood zone map from the relevant authority. These maps categorize areas based on their susceptibility to different flood events, ranging from minor overflows to potential catastrophic floods. For instance, in the United States, the Federal Emergency Management Agency (FEMA) provides detailed Digital Flood Insurance Rate Maps (DFIRMs). Homebuyers should scrutinize these maps to identify any structures within high-risk zones. If a property falls within a Special Flood Hazard Area (SFHA), as designated by FEMA, specific measures must be taken to reduce flood risks.

Once a property’s location is identified on the flood zone map borrower requirements become clearer. Lenders typically require borrowers purchasing real estate in high-risk areas to obtain flood insurance. This insurance, often mandatory for SFHA properties, provides financial protection against potential water damage. According to data from the National Flood Insurance Program (NFIP), over 19 million properties are located in flood zones across the United States, emphasizing the widespread relevance of these measures. Homebuyers should consult with lenders and insurance providers to understand the specific policies and coverage options available.

Beyond insurance, homebuyers can implement additional steps to mitigate flood hazards. These include installing check valves in drainage systems to prevent water from backing up into homes, raising essential appliances and electrical systems above potential flood levels, and ensuring proper land grading to direct stormwater away from buildings. By taking these proactive measures, borrowers not only protect their investment but also enhance the overall resilience of their properties against future flooding events.