In the real estate market, understanding your property’s risk of flooding is paramount for informed decision-making, especially for first-time buyers. The intricate details of a flood zone map serve as a critical tool for gauging these risks, offering insights that can shape significant financial and safety considerations. This comprehensive report aims to demystify the complexities of these maps, providing an in-depth guide tailored for aspiring property owners. By navigating the nuances of flood zones, we empower buyers with the knowledge necessary to make sound choices, ensuring both investment security and community safety.

Understanding Flood Zones: A Primer for Buyers

Understanding Flood Zones is a crucial step for first-time buyers navigating the complexities of home ownership, especially in regions prone to flooding. A flood zone map serves as a vital tool, offering detailed information about areas at risk from inundation. These maps are not merely aesthetic additions; they are regulatory documents that influence borrower requirements and insurance policies. Lenders typically demand evidence of flood zone compliance before approving mortgages, ensuring borrowers understand the potential risks associated with their prospective properties.

Flood zones are classified based on historical data and floodplain topography, ranging from low-risk areas to those with highest susceptibility. Zones like A, B, and C denote varying degrees of hazard. Zone A represents major flood hazards, while Zone C indicates minimal risk. Borrowers purchasing in high-risk areas may be subject to stricter lending standards and required to obtain flood insurance, a crucial aspect of their financial obligations. For instance, in the United States, the Federal Emergency Management Agency (FEMA) publishes detailed flood zone maps that lenders utilize for loan underwriting.

When considering a purchase, it’s essential for buyers to study these maps meticulously. They should verify if the property falls within a flood zone and assess the potential implications on their borrowing power and insurance costs. A proactive approach involves consulting with mortgage specialists who can guide borrowers through the process, ensuring they meet all necessary requirements. Understanding the intricacies of flood zones empowers first-time buyers to make informed decisions, mitigating financial risks associated with these critical regulatory considerations.

Accessing Your Area's Flood Zone Map Online

When considering a property purchase, especially for the first time, understanding your area’s flood zone map is crucial. This essential tool provides detailed information about the likelihood of flooding in any given location, allowing prospective borrowers to make informed decisions. Many lenders now require access to a flood zone map as part of their borrower requirements before issuing mortgages.

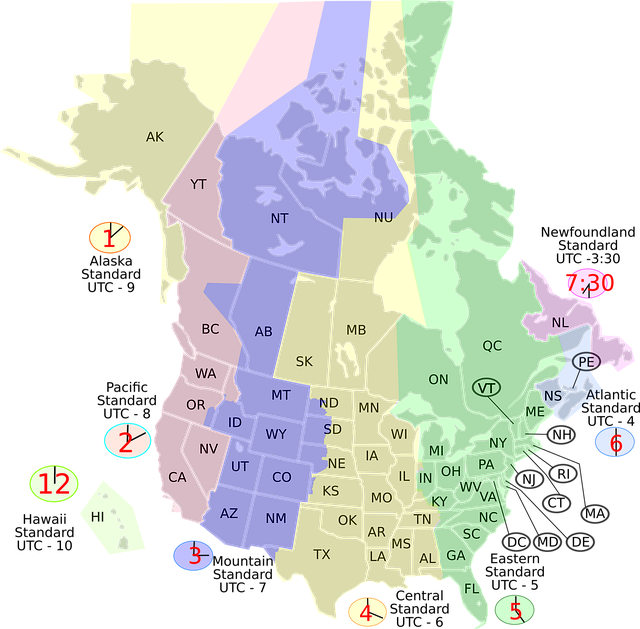

Accessing an accurate and up-to-date flood zone map is straightforward thanks to online resources. The Federal Emergency Management Agency (FEMA) offers a comprehensive digital mapping tool that allows users to input addresses or search by geographic location. This interactive map provides detailed layers, including historical flood data and high-resolution imagery, enabling potential buyers to visualize the risks. For instance, a recent study revealed that over 14 million properties in the United States are located in flood zones, emphasizing the importance of this knowledge for borrowers.

Once on the FEMA website, users can navigate through various layers to gain insights into their property’s vulnerability. The map displays different risk levels, from low to moderate to high flood risks. This visual representation aids in understanding the potential implications and can significantly impact insurance premiums and loan eligibility. Additionally, some states and local governments provide similar tools, ensuring borrowers access relevant, specific data for their regions.

Before proceeding with a purchase, first-time buyers should familiarize themselves with this online resource. It empowers them to make sensible decisions, consider mitigation measures, and understand their borrower requirements. By taking the time to explore these maps, individuals can avoid costly mistakes and ensure they are investing in a secure future, even in flood-prone areas.

Interpreting the Data: What Does the Map Show?

When reviewing a property for purchase, understanding the flood zone map is crucial for any first-time buyer. This map serves as a critical tool to decipher areas prone to flooding, offering essential insights into potential risks and borrower requirements. The data presented on these maps includes detailed information about floodplains, zones, and historical flooding events, all of which play a significant role in mortgage eligibility and insurance considerations.

A flood zone map typically categorizes areas into various zones based on their susceptibility to flooding. Zones A, B, and C, for instance, indicate increasing levels of risk. Zone A represents the highest risk, where flooding is expected with every storm, while Zone C denotes lower likelihood but still potential vulnerability. Such classifications are not only visually represented but often accompanied by detailed studies and data points, such as water flow patterns, elevation, and historical flood events. This comprehensive data allows lenders and borrowers to make informed decisions regarding property acquisition.

For prospective buyers, interpreting this data is key to meeting borrower requirements for a property in a flood zone. Lenders typically assess the risk associated with a specific location and may impose stricter terms or even deny mortgage applications in high-risk areas. Understanding these zones empowers buyers to negotiate, explore alternative financing options, or consider insurance implications early in the process. By being proactive, borrowers can avoid surprises and ensure a smoother transition into homeownership, especially in regions prone to seasonal flooding or living in proximity to rivers and coastal areas.

Impact on Property Purchase and Insurance Decisions

For first-time homebuyers, understanding a flood zone map is crucial before making any property purchase decisions. These maps, developed by federal agencies like FEMA, delineate areas prone to flooding based on historical and scientific data. The impact of these zones extends far beyond mere aesthetics; they significantly influence both property acquisition and insurance considerations. Borrowers navigating the real estate market for the first time often find themselves navigating complex regulatory frameworks surrounding these maps.

Flood zone map borrower requirements mandate that lenders assess a property’s vulnerability to flood risks before approving mortgages. This process involves verifying if a home falls within a Special Flood Hazard Area (SFHA), as identified on the map, which dictates stringent building codes and insurance mandates. For instance, properties in designated zones often require higher down payments or may be ineligible for conventional financing without comprehensive flood insurance coverage. Homebuyers can mitigate these challenges by proactively researching the flood zone map specific to their desired location. Accessing this information through official FEMA resources ensures accuracy and provides valuable insights into potential financial obligations.

In light of recent natural disasters, understanding these maps has become increasingly vital. Data from the National Flood Insurance Program (NFIP) reveals a significant rise in flood-related claims, underscoring the importance of considering flood zones when purchasing real estate. First-time buyers should consult with mortgage lenders and insurance experts to grasp the implications of these zones on their financial plans. Proactive engagement with this information can help buyers avoid costly mistakes and ensure they are fully informed about the property’s long-term financial considerations.

Mitigating Risks: Safety Measures After Buying in a Flood Zone

For first-time homebuyers, purchasing property in a flood zone can seem like a daunting proposition. However, understanding and mitigating risks associated with these areas is crucial for making informed decisions. A comprehensive analysis of the local flood zone map is an essential step in this process. This tool, often required by lenders (as part of borrower requirements) before finalizing any transaction, offers detailed insights into potential hazards and helps buyers assess the safety measures necessary for their new home.

Flood zone maps, typically provided by federal, state, or local agencies, categorize areas based on their susceptibility to flooding events. These maps are dynamic, factoring in historical flood data, topography, drainage patterns, and climate change projections. By studying these visual representations, borrowers can gain a clearer understanding of the extent of the risk. For instance, zones designated as high-risk flood areas require stringent safety protocols, while low-risk regions may have less stringent measures in place.

Upon identifying a potential property within a flood zone, buyers should engage with local experts and authorities to grasp the specific challenges and precautions unique to that area. This could include infrastructure upgrades, such as improved drainage systems or sea walls, which significantly enhance safety. Additionally, purchasing flood insurance is often mandatory for borrowers in high-risk zones (as per borrower requirements), providing financial protection against potential losses. It’s important to note that these measures can vary widely based on the severity of the flood zone and local regulatory frameworks.

In conclusion, navigating the complexities of a flood zone map is an essential step for first-time buyers aiming to safeguard their investment. By understanding the implications, engaging with local experts, and adhering to necessary borrower requirements (including insurance obligations), prospective homeowners can make informed choices, ensuring their new residence remains a haven even amidst potential flooding risks.