Understanding flood zone maps, maintained by FEMA, is crucial for real estate and financing decisions. These maps use color-coding to classify flood risk levels (High, Moderate, Low), influencing loan terms like interest rates and insurance requirements. Borrowers should consult these maps to avoid stringent criteria or denials, especially in high-risk zones where special mitigation measures may be demanded. Proactive adaptation to evolving environmental conditions is essential for compliance and protection against increasing flooding risks.

In an era where climate change poses increasingly frequent and severe weather events, understanding one’s risk to flooding is more critical than ever for homeowners. Navigating the complexities of flood zone maps can be a daunting task for consumers, leaving many unsure of their vulnerability and subsequent insurance needs. This comprehensive guide aims to demystify the flood zone map, providing an authoritative resource for consumers seeking to protect themselves against these natural disasters. By the end, readers will possess the knowledge necessary to make informed decisions regarding their property’s safety and insurance coverage.

Understanding Flood Zone Maps: A Basic Guide

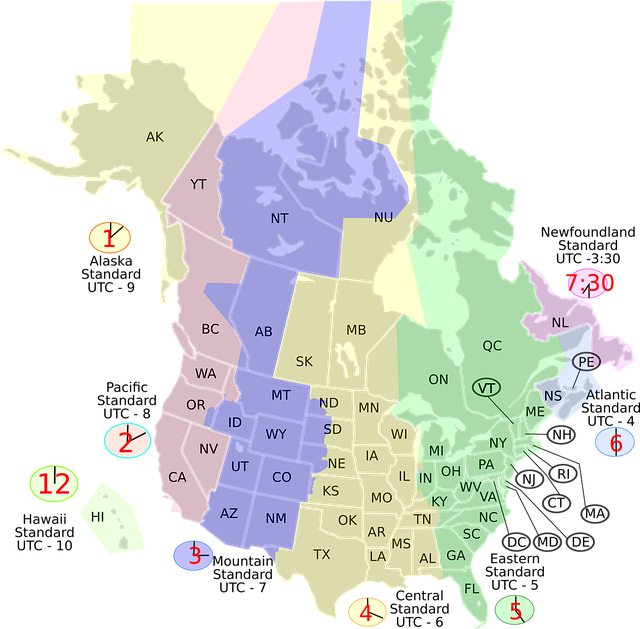

Understanding flood zone maps is a crucial step for any consumer looking to navigate real estate or finance options in vulnerable areas. These detailed tools are designed to communicate the risk of flooding in specific locations, helping lenders and borrowers make informed decisions. The primary tool here is the flood zone map, which uses color-coding and zones to indicate different levels of flood hazard.

For instance, the Federal Emergency Management Agency (FEMA) maintains comprehensive flood zone maps that utilize data from historical floods, hydrologic studies, and topographical surveys. These maps classify areas as High, Moderate, or Low risk, each with distinct implications for borrowing power. Knowing these classifications is paramount for borrowers since lenders often require a thorough understanding of local flood risks when assessing property-backed loans. The flood zone map borrower requirements can significantly impact the loan process and terms, affecting everything from interest rates to insurance policies.

Lenders typically use these maps to ensure they comply with Federal Disaster Protection Act guidelines, which mandate that loans in high-risk areas carry appropriate flood insurance. A flood zone map can also help borrowers avoid potential pitfalls like unexpected premium increases or loan denials due to location. For instance, a property in a previously unknown high-risk area could face more stringent lending criteria, including higher down payments or adjusted loan amounts. Therefore, it’s essential for consumers to familiarize themselves with these maps well before engaging in any real estate transactions or seeking financing.

How to Read and Interpret Your Local Map

Understanding your local flood zone map is a crucial step for any homeowner or prospective borrower navigating the real estate market, especially in areas prone to flooding. This resource aims to demystify these maps and equip you with the knowledge to interpret them effectively. The flood zone map is a detailed geographical representation that identifies zones at various risk levels of flooding based on historical and scientific data. It serves as a critical tool for lenders when assessing property and determining borrower requirements, particularly for mortgage applications in high-risk areas.

To read and decipher your map, start by identifying the different color-coded zones. Each zone represents a distinct flood risk level, typically designated by varying shades of blue or red. The most at-risk areas are usually marked as Special Flood Hazard Areas (SFHAs), indicated by darker hues. These zones have historically experienced frequent flooding events and require specific measures to mitigate risks. Lenders will often demand additional insurance policies for properties located in these areas, known as flood insurance policies, which protect both the lender and borrower against potential financial losses.

An example of a practical application would be when buying a home near a river. If your local map identifies a portion of the neighborhood as a 100-year flood zone, this means there’s a one percent chance of that area being flooded in any given year. Lenders may require a more substantial down payment or charge higher interest rates for mortgages in such areas to compensate for the increased risk. By understanding these nuances, borrowers can be better prepared and make informed decisions when purchasing property in potential flood zones.

Assessing Risk: Identifying High-Risk Areas

Assessing risk is a critical step when understanding your property’s vulnerability to flooding. A flood zone map serves as a powerful tool for evaluating these risks by illustrating areas prone to inundation during various water events. These maps are essential resources for borrowers considering properties in potential flood zones, especially as they navigate the mortgage process. Lenders often require borrowers to review and understand local flood zone mapping data as part of their loan application procedures.

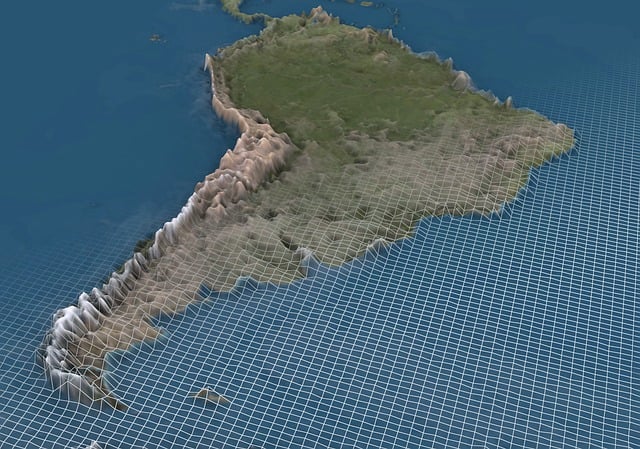

Identifying high-risk areas involves analyzing historical flood data, topography, and drainage patterns. For instance, properties located near rivers, lakes, or coastal regions are more susceptible to flooding. The Federal Emergency Management Agency (FEMA) maintains comprehensive flood maps that categorize zones based on the likelihood of flooding. These include Special Flood Hazard Areas (SFHAs), which have a 1% annual chance of flooding, and other areas with varying degrees of risk. By studying these maps, borrowers can gain insights into potential risks and make informed decisions about their future investments.

For instance, in regions prone to tropical storms, storm surge data is crucial. Maps can illustrate the predicted path and impact of such surges, helping borrowers understand the extent of potential flooding. Additionally, understanding local elevation plays a significant role; lower-lying areas tend to be at higher risk. Borrowers should also consider recent flood history—areas with recurring floods may face more severe risks in the future. When purchasing or refinancing within these zones, lenders will often require additional measures to mitigate risks, such as obtaining flood insurance policies, ensuring proper structural upgrades, and adhering to local building codes designed to minimize flood damage.

Mitigating Hazards: What You Can Do at Home

Understanding your flood zone map is crucial for mitigating hazards and protecting your home—and this knowledge is especially vital if you’re a borrower considering property in areas prone to flooding. These maps, developed by local governments and national agencies, provide detailed information about flood risks, helping residents make informed decisions. For instance, the Federal Emergency Management Agency (FEMA) offers comprehensive flood zone maps that use various colors to designate different risk levels—from low to high—allowing homeowners to assess their potential exposure.

Before purchasing a property in a flood-prone area, borrowers should thoroughly review these maps and consult with lenders who can guide them on specific borrower requirements related to flood zone mapping. These requirements often include ensuring that insurance coverage is adequate for the risks involved. Homeowners can also take proactive steps such as installing check valves in their sewer lines to prevent backflow of floodwaters into their homes, reinforcing doors and windows, and elevating essential appliances and electronics above potential flood levels.

Additionally, making your home flood-ready involves creating a disaster preparedness kit with essentials like a first aid kit, flashlights, non-perishable food, and clean water—all crucial during power outages that often follow flooding events. Regularly updating your flood zone map and staying informed about local emergency procedures can further enhance your family’s safety and minimize potential damage. By embracing these measures, borrowers in flood zones not only meet lender requirements but also contribute to their community’s overall resilience against natural disasters.

Future Proofing: Adapting to Changing Environment

In an era of escalating climate change, understanding and preparing for potential risks is paramount for any property owner or borrower. One critical tool in this preparation is the flood zone map—a comprehensive resource that depicts areas prone to flooding based on historical data and predictive models. As environmental shifts alter weather patterns, these maps evolve, too, demanding a proactive approach from borrowers seeking resilience against future uncertainties.

Future-proofing your property involves acknowledging the dynamic nature of flood zones and adapting accordingly. Lenders, in particular, are increasingly considering flood zone maps as part of borrower requirements. According to recent studies, over 20% of U.S. properties located in high-risk areas have no formal flood protection measures in place, leaving borrowers vulnerable to substantial financial losses. A study by the National Oceanic and Atmospheric Administration (NOAA) reveals that climate change could increase the frequency and severity of flooding events, underscoring the urgency for proactive adaptation.

Borrows should not only consult the latest flood zone maps but also engage with experts to evaluate their property’s specific risks. This might involve assessing elevation levels, understanding nearby water bodies’ behaviors during extreme weather, and considering historical flooding data. Proactive measures such as elevating essential appliances and systems, installing waterproof barriers, or even relocating structures can significantly mitigate damages. By embracing these adaptive strategies, borrowers not only comply with lender requirements for flood zone maps but also protect their investments, ensuring resilience against the ever-changing environmental landscape.